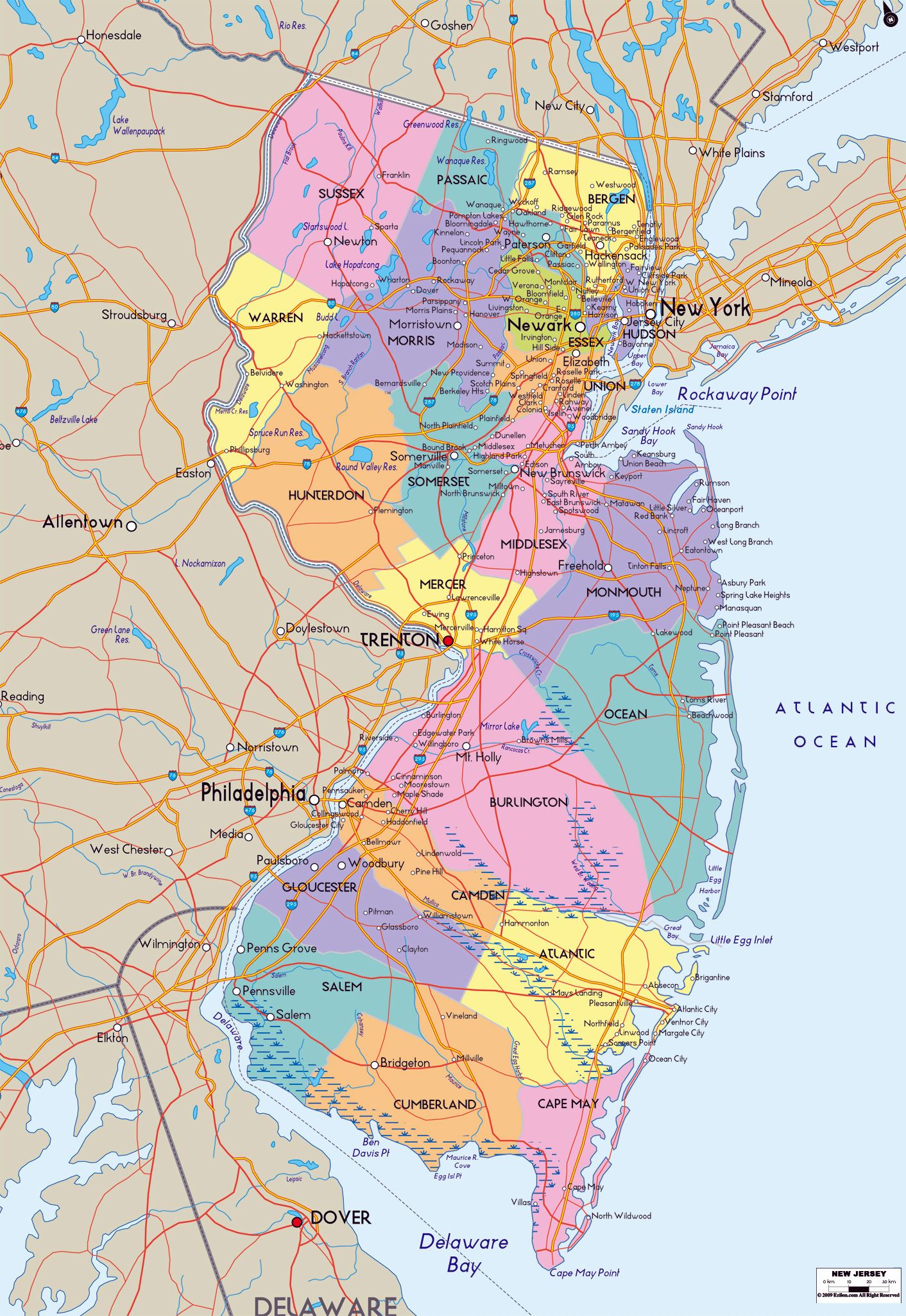

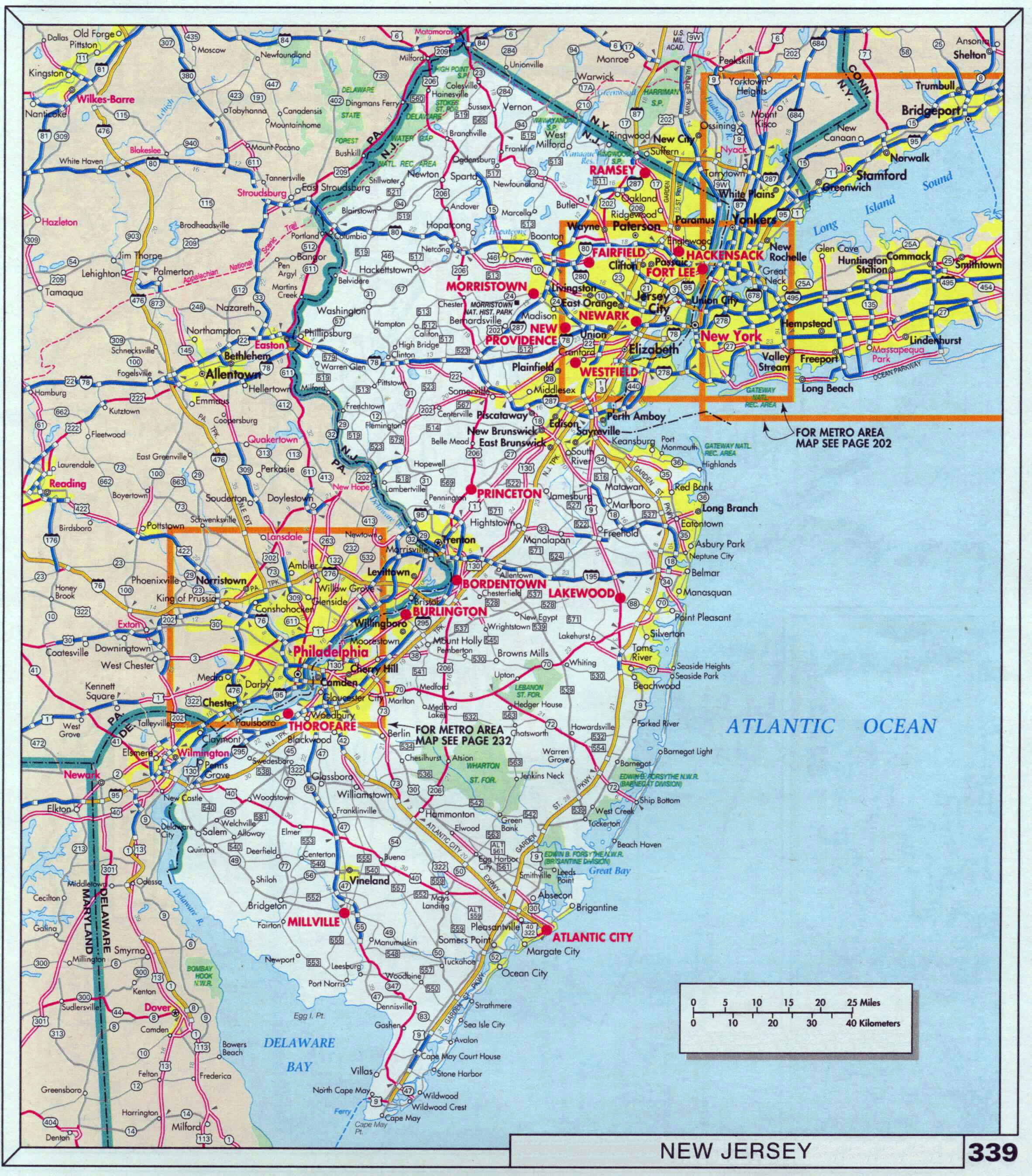

New Jersey, with its diverse geography ranging from coastal plains to mountainous regions, is particularly vulnerable to flooding. From the devastating impacts of Superstorm Sandy to more localized events, the Garden State has witnessed firsthand the destructive power of water. Understanding and utilizing New Jersey flood zone maps is therefore crucial for homeowners, businesses, and community planners to mitigate risk, protect property, and ensure a safer future.

This article provides a comprehensive overview of NJ flood zone maps, exploring their purpose, how they are created and interpreted, the implications for property owners, and the resources available to navigate this complex landscape.

What are NJ Flood Zone Maps?

NJ flood zone maps, also known as Flood Insurance Rate Maps (FIRMs), are visual representations of areas with varying degrees of flood risk. They are developed and maintained by the Federal Emergency Management Agency (FEMA) in conjunction with state and local authorities. These maps are based on engineering studies that analyze factors such as historical flood data, topography, rainfall patterns, and river flow.

The primary purpose of flood zone maps is to:

- Identify areas at risk of flooding: The maps delineate areas prone to different types of flooding, including riverine flooding, coastal flooding, and flash flooding.

- Determine flood insurance requirements: Properties located in high-risk flood zones (typically designated as zones beginning with the letters A or V) are mandated to carry flood insurance if they have a federally backed mortgage.

- Guide land use planning and development: Local governments use flood zone maps to make informed decisions about zoning regulations, building codes, and infrastructure development, aiming to minimize future flood damage.

- Inform emergency management planning: Emergency responders rely on flood zone maps to plan evacuation routes, identify vulnerable populations, and allocate resources effectively during flood events.

How are Flood Zone Maps Created?

The creation of flood zone maps is a complex and multi-faceted process involving:

- Data Collection: Extensive data is gathered, including:

- Historical Flood Data: Analyzing past flood events, including their frequency, intensity, and extent.

- Topographic Data: Mapping the elevation and terrain of the land.

- Hydrologic Data: Studying rainfall patterns, river flow, and drainage systems.

- Coastal Data: Assessing shoreline erosion, wave action, and storm surge potential.

- Engineering Analysis: Using sophisticated hydraulic and hydrologic models, engineers simulate flood events and determine the potential extent and depth of flooding in different areas. This involves:

- Developing Flood Frequency Curves: Estimating the probability of floods of different magnitudes occurring in a given year.

- Modeling Floodplain Boundaries: Delineating the areas that would be inundated by floods of specific frequencies, such as the 100-year flood (also known as the 1% annual chance flood).

- Map Production: The results of the engineering analysis are then translated into visual maps. These maps typically include:

- Flood Zones: Areas classified based on their flood risk.

- Base Flood Elevations (BFEs): The estimated height to which floodwaters are expected to rise during the 100-year flood.

- Cross Sections: Profiles of the terrain along specific lines, showing the elevation of the land and the water surface elevation during a flood.

- Map Legends and Notes: Providing explanations of the map symbols, zone designations, and other relevant information.

- Community Review and Adoption: Draft flood zone maps are presented to local communities for review and feedback. After incorporating community input, FEMA formally adopts the maps.

- Map Updates: Flood zone maps are not static. They are regularly updated to reflect changes in land use, development, and climate conditions. FEMA conducts Flood Risk Studies to reassess flood hazards and revise maps accordingly.

Understanding Flood Zone Designations:

NJ flood zone maps use a variety of designations to categorize areas based on their flood risk. Here’s a breakdown of the most common zone designations:

- High-Risk Flood Zones (Special Flood Hazard Areas – SFHAs): These zones have a 1% or greater chance of flooding in any given year. Properties in these zones are typically required to carry flood insurance if they have a federally backed mortgage.

- Zone A: Areas subject to inundation by the 100-year flood. BFEs may or may not be determined.

- Zone AE: Areas subject to inundation by the 100-year flood. BFEs are determined.

- Zone AH: Areas subject to inundation by shallow flooding (usually sheet flow), with an average depth of 1 to 3 feet. BFEs are determined.

- Zone AO: Areas subject to inundation by shallow flooding (usually sheet flow), with an average depth of 1 to 3 feet. Flood depths are determined.

- Zone VE: Areas subject to inundation by the 100-year flood with additional hazards due to wave action. BFEs are determined. These are coastal high hazard areas.

- Moderate-Risk Flood Zones: These zones have a moderate risk of flooding, typically between 0.2% and 1% annual chance. Flood insurance is not federally mandated in these zones, but it is still recommended.

- Zone B (or Zone X – shaded): Areas subject to inundation by the 500-year flood; areas subject to the 100-year flood with average depths less than one foot or with drainage areas less than one square mile; and areas protected by levees from the 100-year flood.

- Low-Risk Flood Zones: These zones have a low risk of flooding, less than 0.2% annual chance.

- Zone C (or Zone X – unshaded): Areas determined to be outside the 500-year floodplain.

- Undetermined Risk Flood Zones: These are areas where flood risk has not been determined.

- Zone D: Areas where flood hazards are undetermined, but possible. Flood insurance is recommended.

Implications for Property Owners:

The flood zone designation of a property has significant implications for homeowners and businesses:

- Flood Insurance Requirements: As mentioned earlier, properties in high-risk flood zones with a federally backed mortgage are required to carry flood insurance. The cost of flood insurance can vary significantly depending on the flood zone, the elevation of the property relative to the BFE, and the amount of coverage.

- Building Codes and Regulations: Local building codes often require stricter construction standards for properties in flood zones, such as elevating the lowest floor above the BFE, using flood-resistant materials, and implementing proper drainage systems.

- Property Values: Flood zone designations can impact property values. Properties in high-risk flood zones may be less desirable to buyers, potentially leading to lower sale prices.

- Development Restrictions: Local governments may impose restrictions on development in flood zones to minimize future flood damage. This can include limitations on building height, density, and the types of structures that can be built.

Accessing and Interpreting NJ Flood Zone Maps:

NJ flood zone maps are readily available online through the FEMA Flood Map Service Center (MSC): https://msc.fema.gov/portal/home.

Here’s how to use the MSC:

- Enter Your Address: Type in your address in the search bar.

- View Your Flood Map: The MSC will display the relevant flood map for your property.

- Identify Your Flood Zone: Locate your property on the map and identify the flood zone designation.

- Review Map Legends and Notes: Carefully read the map legends and notes to understand the map symbols, zone designations, and other relevant information.

- Determine Your BFE: If your property is in a high-risk flood zone, locate the BFE for your area. This is the estimated height to which floodwaters are expected to rise during the 100-year flood.

- Consult with Local Officials: Contact your local building department or floodplain manager for more information about flood regulations and building codes in your area.

Resources and Assistance:

Navigating the complexities of flood zone maps and flood insurance can be challenging. Fortunately, numerous resources are available to assist property owners:

- FEMA: FEMA provides a wealth of information about flood hazards, flood insurance, and flood mitigation. Their website (https://www.fema.gov/) is a valuable resource.

- National Flood Insurance Program (NFIP): The NFIP provides flood insurance to homeowners, renters, and business owners. Their website (https://www.floodsmart.gov/) offers information about flood insurance coverage and rates.

- NJ Department of Environmental Protection (NJDEP): The NJDEP works to protect the state’s natural resources and manage flood risks. Their website (https://www.nj.gov/dep/) provides information about flood mitigation programs and resources.

- Local Building Departments and Floodplain Managers: Your local building department and floodplain manager are your primary points of contact for information about flood regulations and building codes in your area. They can also provide assistance with interpreting flood zone maps and understanding your flood risk.

- Insurance Agents: A qualified insurance agent can help you assess your flood risk and determine the appropriate amount of flood insurance coverage.

- Certified Floodplain Surveyors: A certified floodplain surveyor can conduct an elevation survey of your property to determine its elevation relative to the BFE. This information is crucial for determining your flood insurance rates and for complying with building codes.

Conclusion:

Understanding NJ flood zone maps is essential for protecting your property, mitigating flood risk, and ensuring a safer future. By utilizing the resources and information available, homeowners, businesses, and community planners can make informed decisions about flood insurance, building codes, and land use planning, ultimately reducing the devastating impacts of flooding in the Garden State. Stay informed, be prepared, and work together to build a more resilient New Jersey.