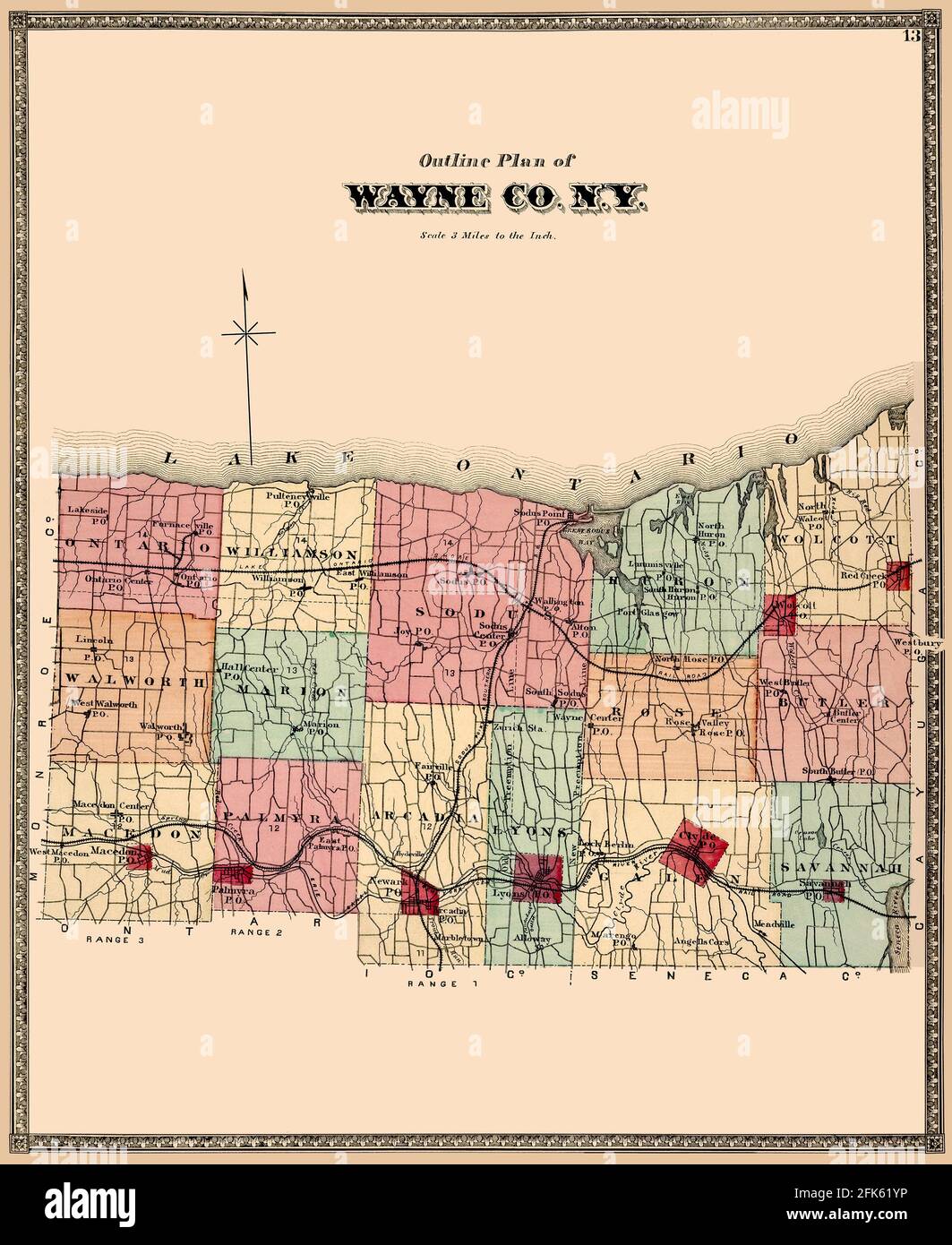

The Wayne County Tax Map is a vital, yet often overlooked, resource for anyone dealing with real estate within the county. From potential homebuyers and seasoned property owners to developers and legal professionals, understanding how to read and utilize this intricate map system is crucial for making informed decisions, avoiding costly errors, and navigating the complexities of property ownership. This article will delve into the intricacies of the Wayne County Tax Map, explaining its purpose, components, how to access it, and its practical applications.

What is the Wayne County Tax Map?

The Wayne County Tax Map, maintained by the Wayne County Assessor’s Office, is a comprehensive visual representation of all real property within the county’s boundaries. It’s not just a simple map; it’s a meticulously crafted system that combines geographical information with property ownership data for the purpose of accurate property assessment and taxation. Think of it as a detailed inventory of every parcel of land, each meticulously numbered and linked to crucial information about its ownership, size, location, and assessed value.

The primary purpose of the tax map is to facilitate the fair and equitable assessment of property taxes. By visually representing property boundaries and linking them to ownership records, the Assessor’s Office can ensure that each parcel is assessed correctly based on its characteristics and market value. This ensures that the tax burden is distributed fairly across all property owners within Wayne County.

Beyond taxation, the tax map serves as a valuable resource for a multitude of other purposes, including:

- Property Identification: Accurately identifying the location and boundaries of a specific property.

- Title Research: Assisting in the process of researching property ownership history and potential encumbrances.

- Development Planning: Providing developers with crucial information about property boundaries, easements, and existing land use.

- Legal Disputes: Serving as evidence in property disputes related to boundaries, easements, or ownership.

- Land Use Planning: Assisting local governments in planning for future development and land use.

Understanding the Components of the Tax Map:

The Wayne County Tax Map is organized into a hierarchical system, typically utilizing a combination of maps, grids, and parcel identification numbers (PINs). Understanding this structure is essential for effectively navigating and interpreting the map.

- Tax Map Books (or Sections): Wayne County is divided into manageable sections, each represented by a Tax Map Book (or Section). These books cover specific geographic areas within the county, allowing for a more detailed view of property parcels.

- Pages (or Grids): Within each Tax Map Book, individual pages (or grids) represent smaller areas, further breaking down the landscape into manageable chunks. These pages are typically numbered sequentially within each book.

- Parcel Identification Numbers (PINs): The most critical component of the tax map is the Parcel Identification Number (PIN). This unique identifier is assigned to each individual property parcel within Wayne County. The PIN acts as a key, linking the property’s location on the map to its corresponding record in the Assessor’s Office database.

Decoding the Parcel Identification Number (PIN):

The structure of the PIN can vary depending on the specific system used by Wayne County, but it typically follows a logical format that encodes information about the property’s location. Common elements within the PIN might include:

- Tax Map Book Number: Identifies the specific Tax Map Book (or Section) where the property is located.

- Page Number: Indicates the specific page (or grid) within the Tax Map Book where the property is located.

- Parcel Number: A unique number assigned to the individual property parcel within that specific page.

For example, a PIN might look like this: 12-34-5678. This could indicate that the property is located in Tax Map Book 12, on Page 34, and has a Parcel Number of 5678.

Understanding the structure of the PIN allows you to quickly locate the property on the tax map and access its associated information in the Assessor’s Office database.

Accessing the Wayne County Tax Map:

Accessing the Wayne County Tax Map is generally straightforward, though the specific method may depend on the resources available online and at the Assessor’s Office. Common methods include:

-

Online Access: Many counties, including Wayne County, offer online access to their tax maps through their Assessor’s Office website or a dedicated Geographic Information System (GIS) portal. These online platforms typically allow you to search for properties by address, PIN, or owner name. You can then view the property on the tax map, zoom in for detail, and access associated property information.

- GIS Portals: GIS (Geographic Information System) portals offer interactive mapping tools that allow you to overlay various data layers onto the tax map, such as zoning information, flood zones, or utility lines. These portals provide a more comprehensive view of the property and its surrounding environment.

-

In-Person Access: You can also access the Wayne County Tax Map in person at the Wayne County Assessor’s Office. Staff members can assist you in locating specific properties on the map and accessing related information. Keep in mind that there may be fees associated with printing copies of the tax map or property records.

-

Third-Party Vendors: Several third-party vendors offer online access to tax maps and property records for a fee. These services often provide additional features, such as advanced search capabilities and historical data. However, it’s crucial to verify the accuracy and reliability of information obtained from third-party sources.

Practical Applications of the Wayne County Tax Map:

The Wayne County Tax Map is a valuable tool for a wide range of individuals and organizations. Here are some practical applications:

-

Real Estate Transactions: Before purchasing a property, potential homebuyers can use the tax map to verify the property’s boundaries, identify any potential easements or encroachments, and research the property’s ownership history. This information can help them make informed decisions and avoid costly surprises.

-

Property Development: Developers can use the tax map to identify potential development sites, assess the feasibility of projects, and navigate the complex process of obtaining permits and approvals. The tax map provides crucial information about property boundaries, zoning regulations, and existing land use.

-

Legal Professionals: Attorneys can use the tax map to research property ownership history, resolve boundary disputes, and prepare legal documents related to real estate transactions. The tax map serves as a valuable piece of evidence in property-related legal proceedings.

-

Land Surveyors: Land surveyors use the tax map as a reference point when conducting property surveys. The tax map provides a starting point for accurately determining property boundaries and creating legal descriptions.

-

Government Agencies: Local governments use the tax map for a variety of purposes, including land use planning, zoning enforcement, and emergency response. The tax map provides a comprehensive overview of property ownership and land use patterns within the county.

Common Mistakes and Pitfalls:

While the Wayne County Tax Map is a valuable resource, it’s important to be aware of potential limitations and avoid common mistakes:

-

Relying Solely on the Tax Map for Boundary Determination: The tax map is intended for assessment purposes and should not be used as a substitute for a professional land survey. While the tax map provides a general indication of property boundaries, it may not be accurate enough for legal purposes.

-

Ignoring Discrepancies: If you notice any discrepancies between the tax map and the physical characteristics of the property, it’s crucial to investigate further. Discrepancies may indicate errors in the tax map or potential boundary disputes.

-

Failing to Consult with Professionals: When dealing with complex property matters, it’s always advisable to consult with qualified professionals, such as land surveyors, real estate attorneys, or title companies. These professionals can provide expert guidance and ensure that you are making informed decisions.

-

Outdated Information: Tax maps are updated periodically, but there may be a delay between changes in property ownership or boundaries and the corresponding updates to the tax map. Always verify the accuracy of the information by cross-referencing it with other sources, such as the County Recorder’s Office.

Conclusion:

The Wayne County Tax Map is an indispensable resource for anyone involved in real estate within the county. By understanding its purpose, components, and how to access it, you can unlock a wealth of information about property ownership, boundaries, and assessed values. Whether you’re a potential homebuyer, a seasoned property owner, or a real estate professional, mastering the intricacies of the tax map can empower you to make informed decisions, avoid costly errors, and navigate the complexities of property ownership with confidence. Remember to always verify the accuracy of the information and consult with professionals when dealing with complex property matters. Utilizing this powerful tool effectively will ultimately save you time, money, and potential headaches in the long run.