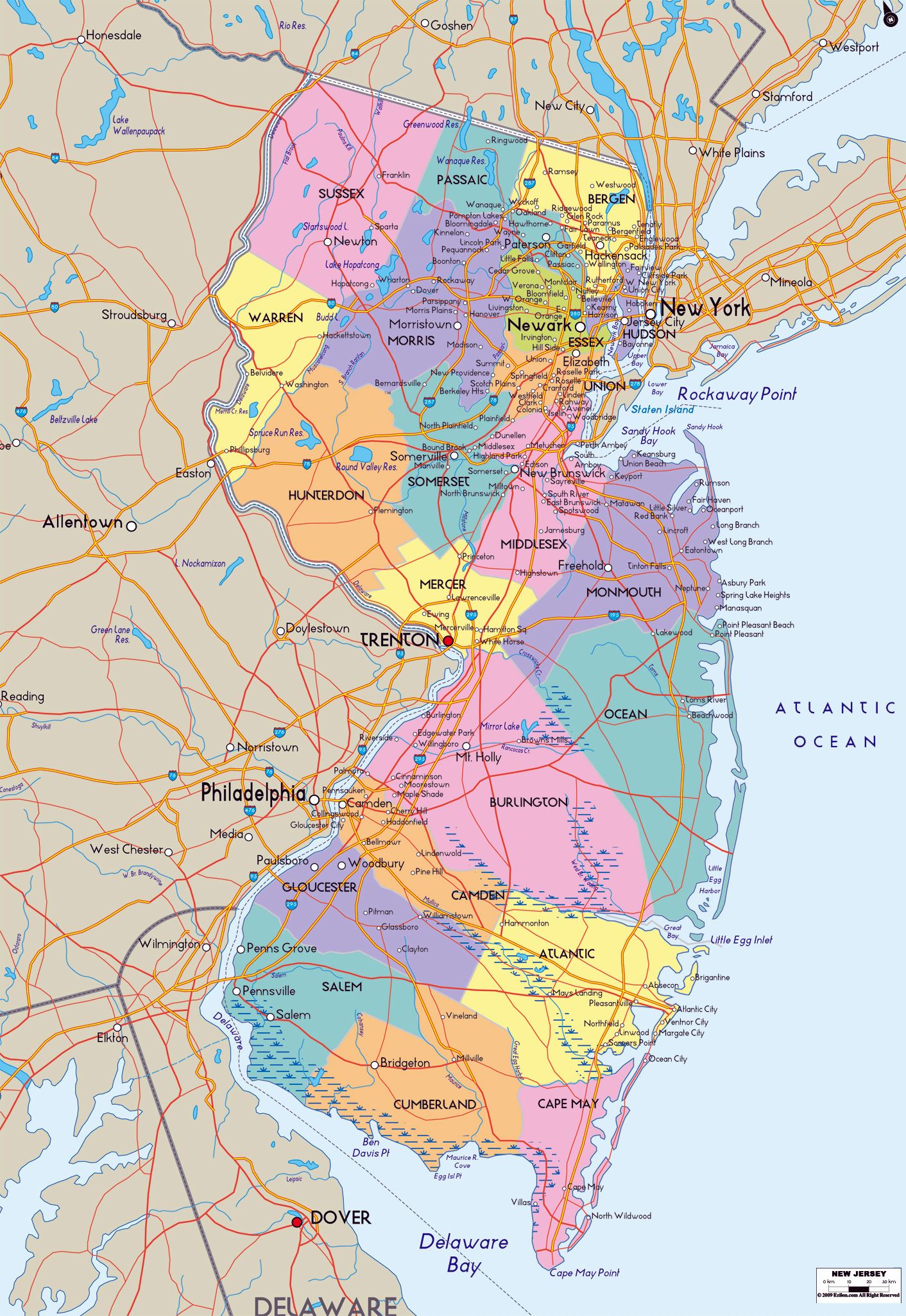

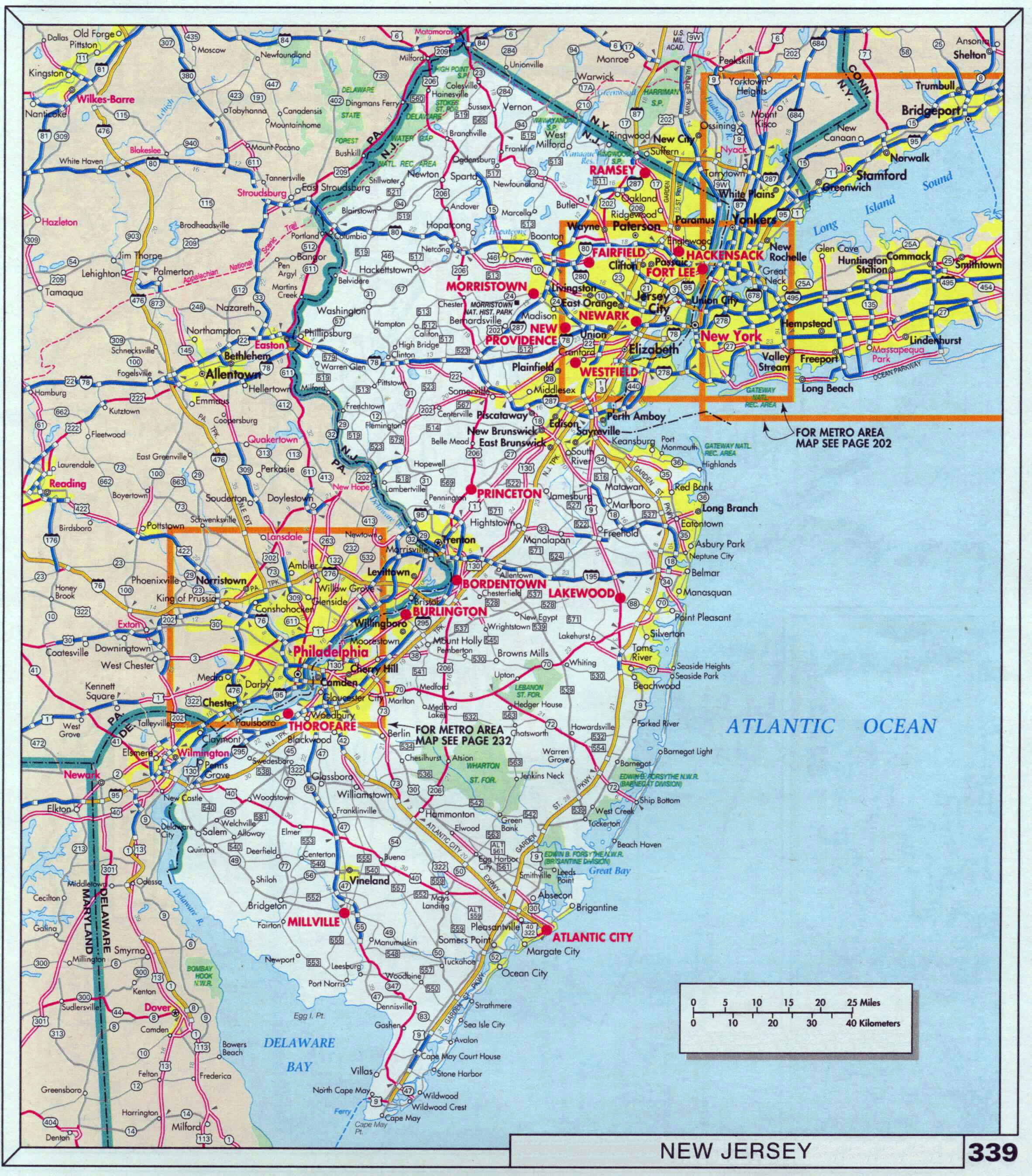

New Jersey, with its extensive coastline, numerous rivers, and dense population, faces a significant and growing threat from flooding. From coastal storm surges during hurricanes to localized flash floods after heavy rainfall, the state is vulnerable to a variety of flood events. To mitigate these risks and help residents make informed decisions about property and safety, the Federal Emergency Management Agency (FEMA) produces Flood Insurance Rate Maps (FIRMs), commonly known as flood zone maps. Understanding these maps is crucial for anyone living, working, or investing in New Jersey.

This article delves into the intricacies of NJ flood zones, exploring the purpose of flood maps, the different flood zone designations, how to access and interpret these maps, and the implications of being located in a designated flood zone.

The Purpose and Importance of Flood Zone Maps

Flood zone maps are more than just lines drawn on a map; they are powerful tools used to:

- Identify Flood Risk: The primary purpose of flood maps is to delineate areas with varying levels of flood risk. This allows communities and individuals to understand the likelihood of flooding in specific locations.

- Determine Flood Insurance Requirements: Flood zone maps are the foundation for the National Flood Insurance Program (NFIP). Properties located in high-risk flood zones are typically required to purchase flood insurance if they have a federally backed mortgage.

- Inform Land Use Planning and Development: Local governments use flood maps to guide land use planning and development regulations. This helps prevent construction in areas most susceptible to flooding and ensures that new construction meets specific flood-resistant standards.

- Support Mitigation Efforts: By highlighting areas prone to flooding, flood maps help communities prioritize mitigation efforts, such as elevating structures, improving drainage systems, and restoring natural floodplains.

- Educate the Public: Flood maps serve as an educational resource, raising awareness about flood risk and empowering residents to take proactive steps to protect themselves and their property.

Understanding Flood Zone Designations in New Jersey

Flood zone maps categorize areas based on their flood risk, using a variety of designations. The most common flood zone designations in New Jersey, and their implications, include:

-

High-Risk Flood Zones (Special Flood Hazard Areas – SFHAs): These zones have a 1% annual chance of flooding, also known as the 100-year floodplain. This means there is a 1% chance that an area within this zone will experience a flood in any given year. SFHAs are further categorized as follows:

- Zone A: Areas subject to inundation by the 1% annual chance flood event. Base Flood Elevations (BFEs) may or may not be determined. Mandatory flood insurance purchase requirements and floodplain management regulations apply.

- Zone AE: Areas subject to inundation by the 1% annual chance flood event. Base Flood Elevations (BFEs) are determined. Mandatory flood insurance purchase requirements and floodplain management regulations apply. This is the most common SFHA designation.

- Zone AH: Areas subject to inundation by 1% annual chance shallow flooding (usually areas of ponding) where depths are between one and three feet. Base Flood Elevations (BFEs) are determined. Mandatory flood insurance purchase requirements and floodplain management regulations apply.

- Zone AO: Areas subject to inundation by 1% annual chance shallow flooding (usually sheet flow on sloping terrain) where depths are between one and three feet. Average depths are shown. Mandatory flood insurance purchase requirements and floodplain management regulations apply.

- Zone VE: Coastal areas with a 1% or greater chance of flooding and subject to wave action. Base Flood Elevations (BFEs) are determined. Mandatory flood insurance purchase requirements and more stringent floodplain management regulations apply due to the increased risk from wave action.

- Zone V: Coastal areas with a 1% or greater chance of flooding and subject to wave action. Base Flood Elevations (BFEs) may or may not be determined. Mandatory flood insurance purchase requirements and more stringent floodplain management regulations apply due to the increased risk from wave action.

-

Moderate-Risk Flood Zones: These zones have a lower risk of flooding compared to SFHAs but are still susceptible to flooding.

- Zone B, Zone X (shaded): Areas with a 0.2% annual chance of flooding, or areas with a 1% annual chance of flooding with average depths less than one foot or drainage areas less than one square mile. Flood insurance is recommended, but not mandatory.

-

Minimal-Risk Flood Zones: These zones have the lowest risk of flooding.

- Zone C, Zone X (unshaded): Areas determined to be outside the 500-year floodplain. Flood insurance is not required, but is always recommended.

Accessing and Interpreting NJ Flood Zone Maps

Flood zone maps are publicly available and can be accessed through several channels:

- FEMA Flood Map Service Center (MSC): This is the official source for FEMA flood maps. You can access the MSC website and search for your property using your address. The MSC provides access to the most up-to-date flood maps, as well as other relevant information, such as Letters of Map Amendment (LOMAs) and Letters of Map Revision (LOMRs).

- Local Municipal Offices: Many local municipal offices in New Jersey have copies of the flood maps for their jurisdiction. Contacting your local building department or planning department can provide access to these maps and assistance in interpreting them.

- Insurance Agents: Insurance agents who sell flood insurance are familiar with flood zone maps and can help you determine your property’s flood zone.

- GIS (Geographic Information System) Platforms: Some counties and municipalities in New Jersey have integrated flood zone data into their online GIS platforms. This allows you to view flood zones overlaid on aerial imagery and other geographic data.

Interpreting a flood zone map involves understanding the following key elements:

- Flood Zones: Identify the flood zone designation for your property. This will determine the level of flood risk and the potential flood insurance requirements.

- Base Flood Elevation (BFE): If your property is located in a Zone AE, AH, or VE, the map will show the Base Flood Elevation (BFE). This is the elevation to which floodwaters are expected to rise during the 1% annual chance flood event. Knowing the BFE is crucial for determining if your building is adequately elevated.

- Map Legend: Refer to the map legend to understand the meaning of the various symbols, lines, and colors used on the map.

- Map Scale: The map scale indicates the relationship between distances on the map and actual distances on the ground. This helps you understand the size and extent of flood zones.

- North Arrow: The north arrow indicates the direction of north on the map. This helps you orient yourself and understand the geographic context of the flood zones.

The Implications of Being Located in a Designated Flood Zone

Being located in a designated flood zone, particularly a high-risk SFHA, has several significant implications:

- Mandatory Flood Insurance: If your property is located in an SFHA and you have a federally backed mortgage, you are typically required to purchase flood insurance through the NFIP or a private flood insurance provider.

-

Floodplain Management Regulations: Properties in flood zones are subject to local floodplain management regulations. These regulations may include requirements for:

- Elevating Structures: New construction and substantial improvements to existing structures may be required to be elevated to or above the BFE.

- Floodproofing: Structures may be required to be floodproofed to protect them from flood damage.

- Restrictions on Development: Development may be restricted or prohibited in certain flood zones.

- Permitting Requirements: Any construction or development activity in a flood zone will likely require a permit from the local municipality.

- Property Value: Location in a flood zone can impact property value, potentially decreasing the market value due to the perceived risk and the added expense of flood insurance.

- Increased Risk of Flood Damage: Living in a flood zone means you are at a higher risk of experiencing flood damage to your property. This can lead to significant financial losses and emotional distress.

- Impact on Mortgage Lending: Mortgage lenders are increasingly scrutinizing properties located in flood zones, and some may be reluctant to provide financing for properties in high-risk areas.

Appealing or Amending Flood Zone Designations

While flood zone maps are based on scientific data and modeling, they are not always perfect. If you believe your property has been incorrectly designated as being located in a flood zone, you have the right to appeal or request an amendment to the flood map.

- Letter of Map Amendment (LOMA): A LOMA is a formal determination by FEMA that a property has been inadvertently included in a Special Flood Hazard Area (SFHA) because the natural ground elevation is higher than the BFE. If you can provide evidence, such as an elevation certificate prepared by a licensed surveyor, demonstrating that your property is above the BFE, you can apply for a LOMA.

- Letter of Map Revision (LOMR): A LOMR is a formal determination by FEMA that revises the current flood hazard information shown on the Flood Insurance Rate Map (FIRM). LOMRs are typically requested when there have been changes to the topography or drainage patterns in an area that affect the flood risk.

The process of appealing or amending a flood map can be complex and may require the assistance of a professional surveyor or engineer.

Conclusion: Proactive Steps for Residents and Property Owners

Understanding NJ flood zones and flood maps is essential for residents, property owners, and anyone involved in real estate in the state. By accessing and interpreting these maps, individuals can make informed decisions about flood insurance, property improvements, and emergency preparedness.

Beyond simply understanding the maps, proactive steps are crucial:

- Purchase Flood Insurance: Even if not required, consider purchasing flood insurance. Standard homeowner’s insurance does not cover flood damage.

- Implement Mitigation Measures: Take steps to reduce your flood risk, such as elevating utilities, installing flood vents, and improving drainage.

- Develop a Flood Emergency Plan: Prepare a plan for what to do in the event of a flood, including evacuation routes and emergency supplies.

- Stay Informed: Stay informed about flood risks in your area by monitoring weather forecasts and heeding warnings from local authorities.

- Advocate for Community Mitigation: Support community-wide efforts to reduce flood risk, such as improving drainage systems and restoring natural floodplains.

By understanding the risks and taking proactive measures, New Jersey residents can navigate the waters and protect themselves and their property from the devastating impacts of flooding. The NJ flood zones map is not just a piece of paper; it is a crucial tool for building a more resilient and flood-safe future for the Garden State.