Navigating the US tax landscape can feel like traversing a complex maze. While federal income tax grabs headlines, the state income tax systems, each with their own unique rules and rates, add another layer of complexity. Understanding this patchwork quilt of state income taxes is crucial for individuals, families, and businesses alike. This article delves into the landscape of state income taxes across the United States, exploring the different models, rates, and key considerations for residents and those considering a move.

The Basics: What is State Income Tax?

State income tax is a tax levied by individual US states on the income earned by residents and, in some cases, non-residents who earn income within the state. This income can include wages, salaries, tips, business profits, investment income, and certain retirement distributions. The revenue generated from state income taxes is a vital source of funding for state-level public services, including education, infrastructure, healthcare, and public safety.

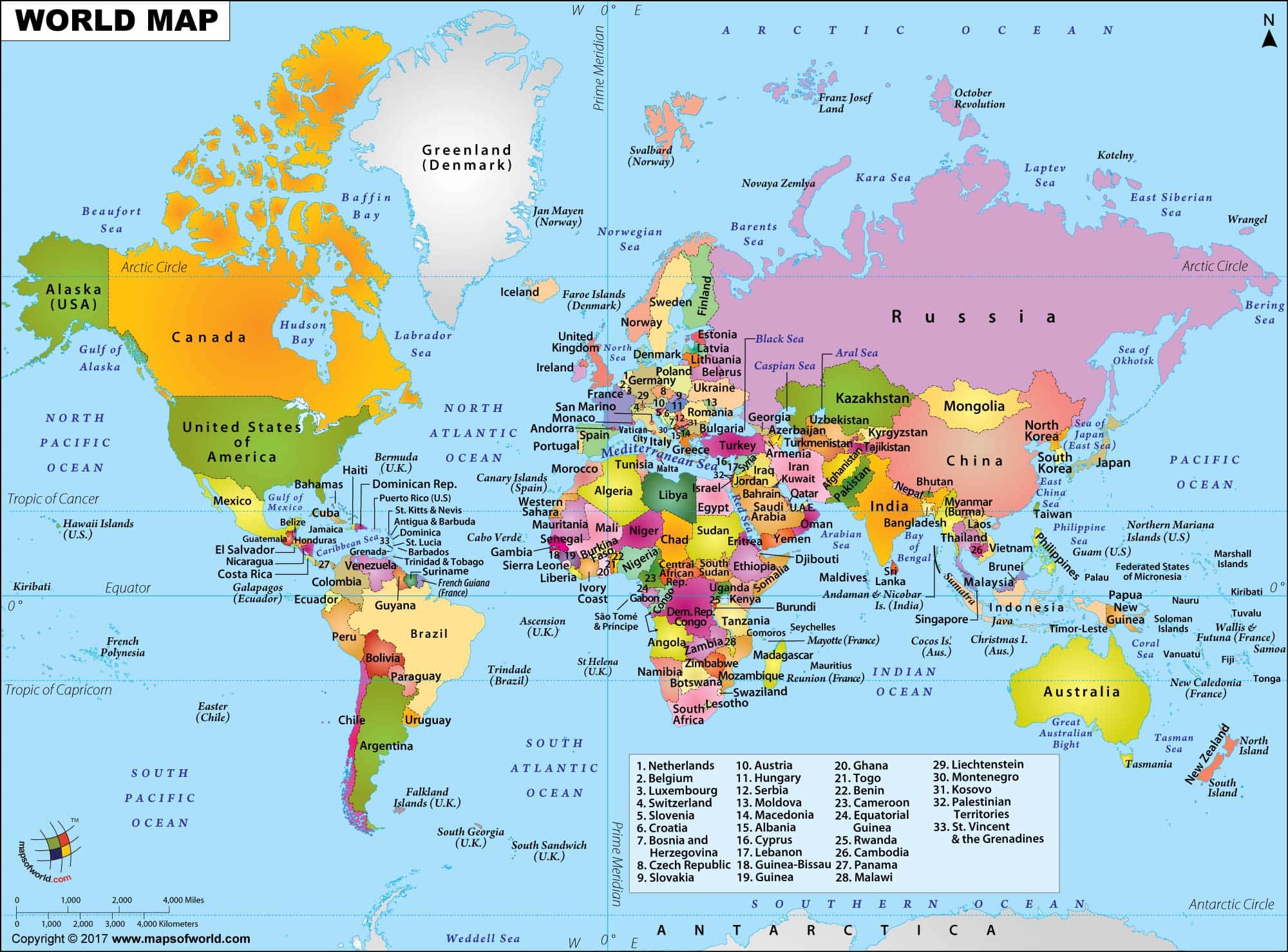

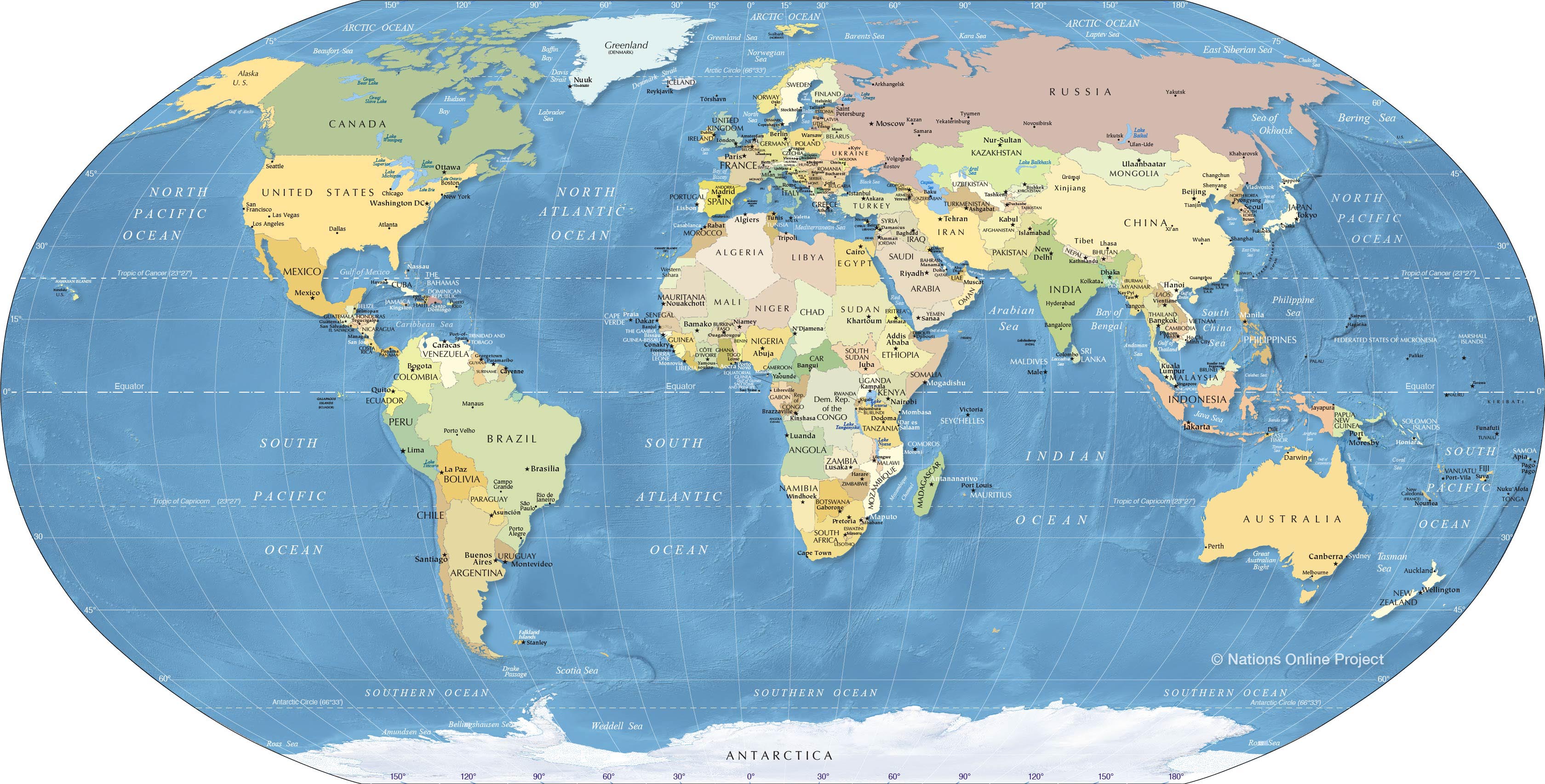

The Map: States With and Without Income Tax

The most fundamental distinction in the state income tax landscape is the presence or absence of the tax itself. Currently, nine states do not have a state income tax on wages and salaries:

- Alaska: Relies heavily on oil revenue.

- Florida: Attracts retirees and benefits from tourism.

- Nevada: Boasts a robust tourism and entertainment industry.

- New Hampshire: Only taxes interest and dividends.

- South Dakota: Focuses on other revenue streams, including sales tax.

- Tennessee: Phased out its income tax on wages and salaries in 2021 but still taxes interest and dividends.

- Texas: Relies heavily on property taxes and oil revenue.

- Washington: Utilizes a high sales tax rate.

- Wyoming: Leverages mineral extraction and tourism.

These states often compensate for the lack of income tax through other means, such as higher sales taxes, property taxes, or reliance on specific industries like tourism or resource extraction. It’s crucial to remember that while these states don’t tax wages, they might still have other taxes that impact residents, such as property taxes or sales taxes.

The Models: Understanding the Different Approaches

States that do levy income tax employ a variety of models, each with its own implications for taxpayers:

-

Progressive Income Tax: This is the most common model. In a progressive system, tax rates increase as income rises. This means higher-income earners pay a larger percentage of their income in taxes than lower-income earners. The idea behind progressive taxation is to distribute the tax burden more equitably. States with progressive income taxes often have multiple tax brackets, each with its own corresponding rate. Examples include California, New York, and Massachusetts.

-

Flat Income Tax: In contrast to progressive systems, a flat income tax applies the same tax rate to all income levels. Regardless of whether you earn $30,000 or $300,000, you’ll pay the same percentage of your income in taxes. Proponents of flat taxes argue that they are simpler to administer and promote economic growth by not penalizing higher earners. Examples include Illinois and Pennsylvania.

-

Graduated Flat Tax: This is a less common approach that blends elements of both progressive and flat tax systems. A graduated flat tax typically has a few income brackets, but the tax rates within those brackets are relatively flat compared to a fully progressive system. This approach aims to provide some degree of progressivity while maintaining simplicity.

Key Considerations: Factors That Influence Your State Income Tax Burden

Beyond the basic model, several other factors can significantly impact your state income tax burden:

-

Tax Brackets and Rates: The specific income thresholds and corresponding tax rates in a progressive system can vary widely from state to state. Understanding the tax brackets in your state is crucial for estimating your tax liability. Some states have relatively few brackets, while others have a more complex system with numerous brackets.

-

Deductions and Credits: Most states offer a variety of deductions and credits that can reduce your taxable income and overall tax liability. Common deductions include those for student loan interest, medical expenses, and retirement contributions. Credits, on the other hand, directly reduce the amount of tax you owe. States often offer credits for things like childcare expenses, energy-efficient home improvements, and charitable donations.

-

Standard vs. Itemized Deductions: Taxpayers typically have the option of taking a standard deduction or itemizing their deductions. The standard deduction is a fixed amount that varies by filing status. Itemizing deductions allows you to deduct specific expenses, such as mortgage interest, state and local taxes (SALT), and charitable contributions. You should choose the option that results in the lower tax liability.

-

SALT Deduction Limit: The federal Tax Cuts and Jobs Act of 2017 imposed a limit on the amount of state and local taxes (SALT) that taxpayers can deduct on their federal tax returns. This limit has significantly impacted taxpayers in high-tax states like California, New York, and New Jersey, as it has effectively increased their overall tax burden.

-

Tax Reciprocity Agreements: Some states have tax reciprocity agreements with neighboring states. These agreements allow residents of one state to work in another state without having to pay income tax in the non-resident state. This can simplify tax filing for individuals who live in one state and work in another.

-

Special Taxes: Some states impose special taxes on specific types of income or activities. For example, New Hampshire and Tennessee tax interest and dividends. Understanding these special taxes is essential for accurately calculating your state income tax liability.

-

Property Taxes: While not directly related to income tax, property taxes are a significant factor to consider when evaluating the overall tax burden in a particular state. States with no income tax often have higher property taxes to compensate for the lost revenue.

-

Sales Taxes: Similarly, sales taxes can vary significantly from state to state. States with no income tax may rely more heavily on sales taxes to fund public services.

Moving Considerations: Evaluating the Tax Landscape Before Relocating

When considering a move to a new state, it’s crucial to carefully evaluate the tax landscape. While the absence of an income tax might seem appealing, it’s important to consider the overall tax burden, including property taxes, sales taxes, and any special taxes. Factors to consider include:

-

Your Income Level: The benefits of moving to a state with no income tax are generally greater for higher-income earners. Lower-income earners may not see a significant tax savings and may even pay more in other taxes.

-

Your Spending Habits: If you tend to spend a lot of money on taxable goods and services, you might end up paying more in sales tax in a state with no income tax.

-

Your Property Ownership: If you own property, you need to consider the property tax rates in the state you are considering moving to.

-

State Services: Consider the quality and availability of public services in the state you are considering. States with lower taxes may have fewer resources to fund essential services like education, healthcare, and infrastructure.

Staying Informed: Resources for Taxpayers

Navigating the complexities of state income taxes can be challenging. Fortunately, there are numerous resources available to help taxpayers stay informed:

-

State Revenue Departments: Each state has a revenue department that provides information on state tax laws, regulations, and forms. These departments typically have websites with comprehensive information for taxpayers.

-

Tax Professionals: Consulting with a qualified tax professional can provide personalized guidance and help you navigate the complexities of state income tax laws.

-

IRS Website: While primarily focused on federal taxes, the IRS website also provides some information on state taxes.

-

Reputable Tax Software: Many tax software programs can help you prepare and file your state income tax returns.

Conclusion: Understanding the Landscape for Financial Well-being

The map of state income taxes is a complex and ever-evolving landscape. Understanding the different models, rates, and key considerations is essential for individuals, families, and businesses alike. By carefully evaluating the tax landscape in your state and the states you are considering moving to, you can make informed decisions that will contribute to your financial well-being. Remember to consult with qualified professionals and utilize available resources to ensure you are compliant with all applicable tax laws. The patchwork quilt of state income taxes requires diligent attention, but with the right knowledge, you can navigate it successfully.