Navigating Property and Finances: A Comprehensive Guide to Richland County’s Tax Map

Related Articles: Navigating Property and Finances: A Comprehensive Guide to Richland County’s Tax Map

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating Property and Finances: A Comprehensive Guide to Richland County’s Tax Map. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating Property and Finances: A Comprehensive Guide to Richland County’s Tax Map

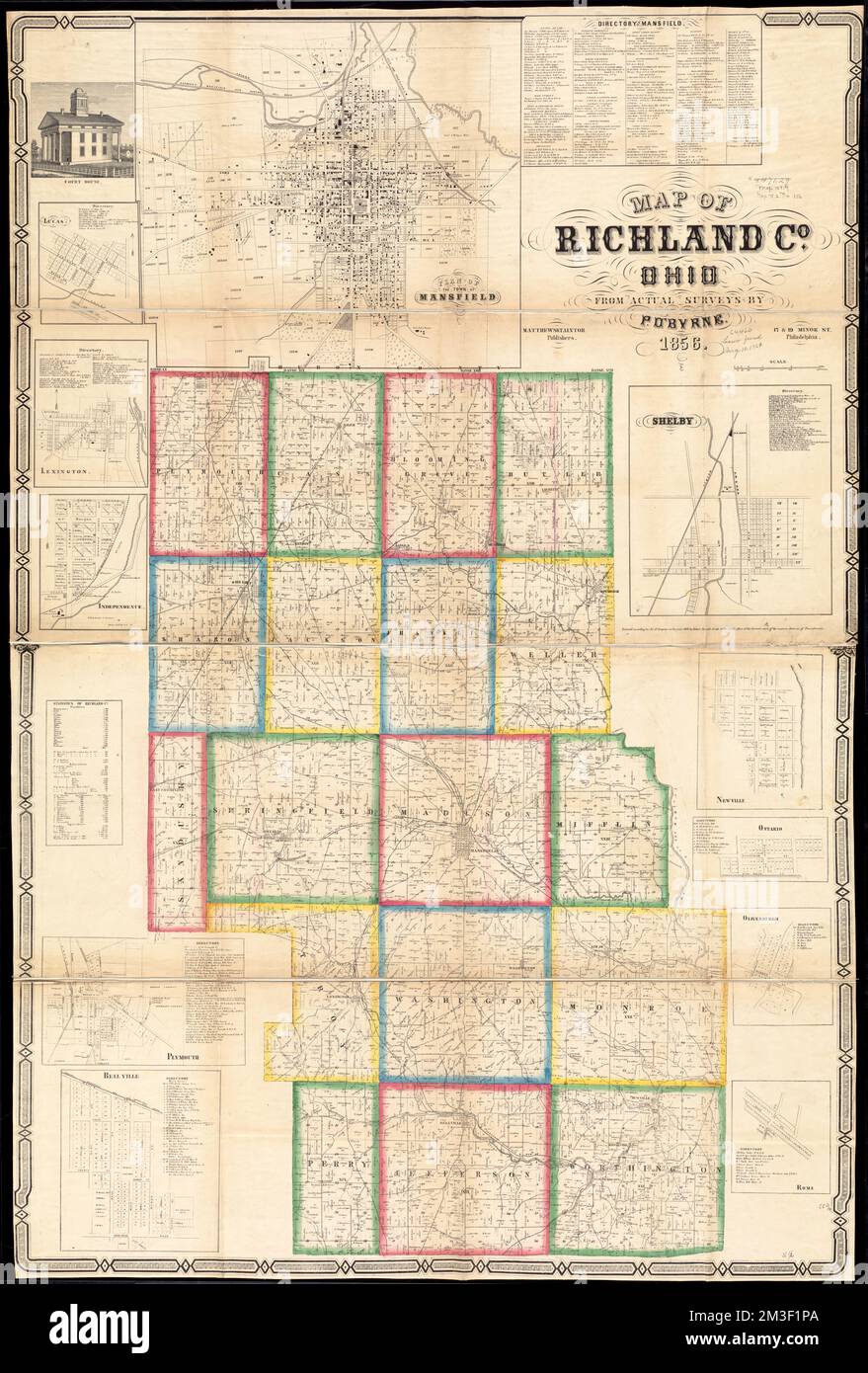

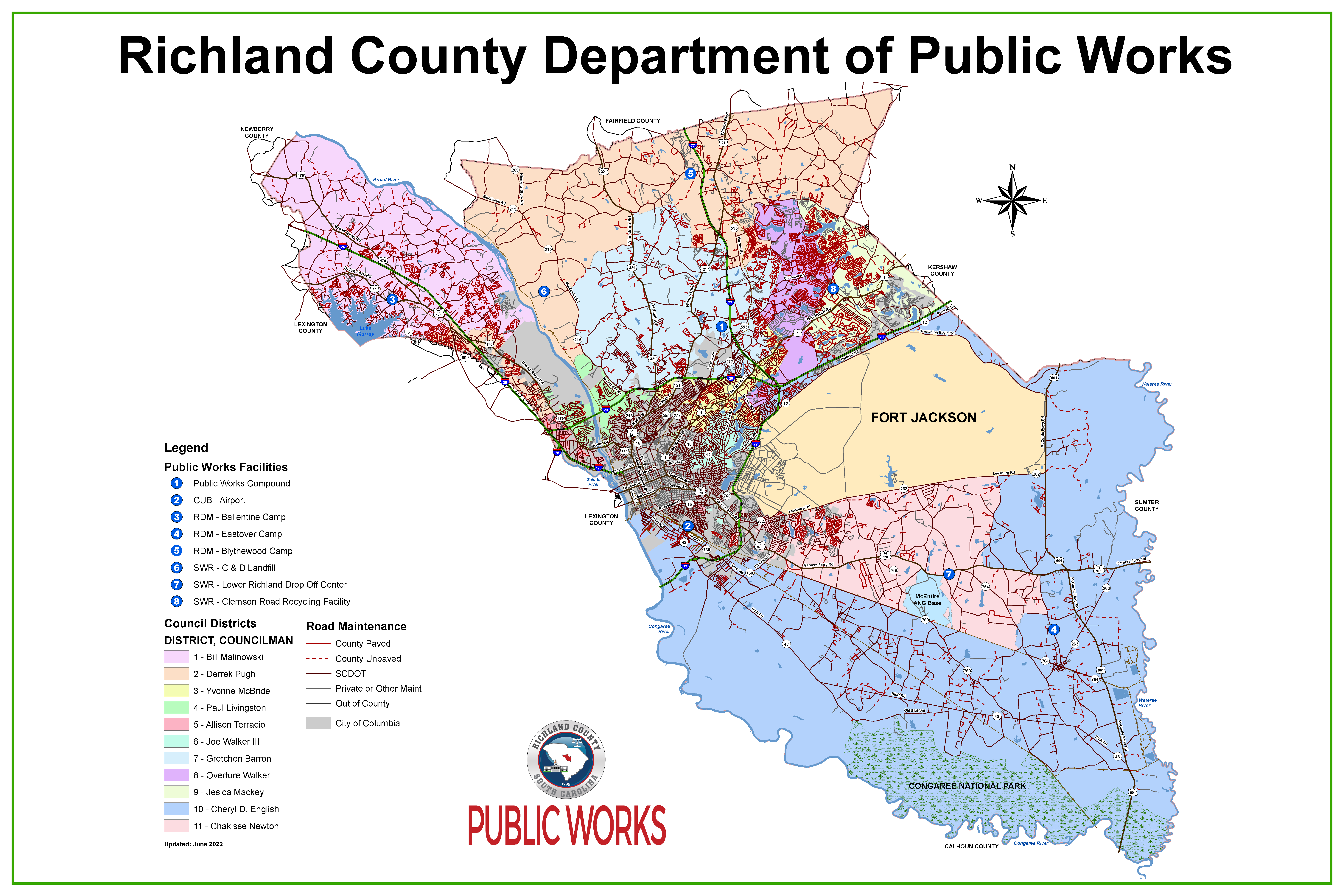

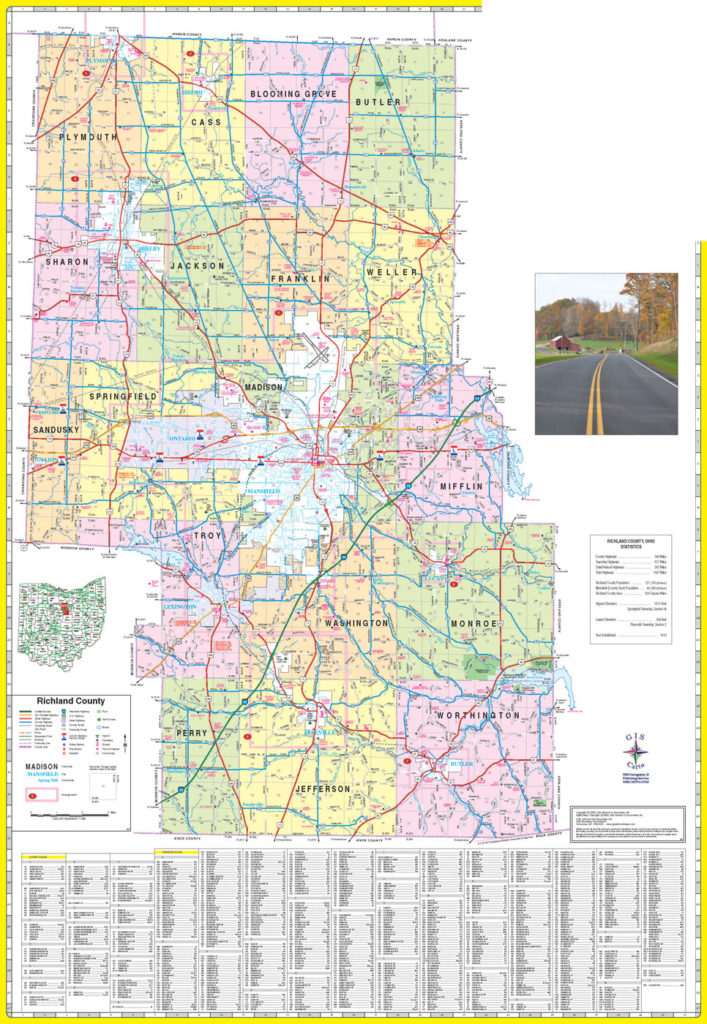

Richland County, like many other jurisdictions, utilizes a tax map as a fundamental tool for managing and understanding property ownership and associated tax liabilities. This detailed visual representation of the county’s land parcels serves as a crucial resource for various stakeholders, including property owners, real estate professionals, government agencies, and even the general public.

This article delves into the intricacies of Richland County’s tax map, exploring its structure, functionalities, and significance in the broader context of property management and local government operations.

Understanding the Structure and Components

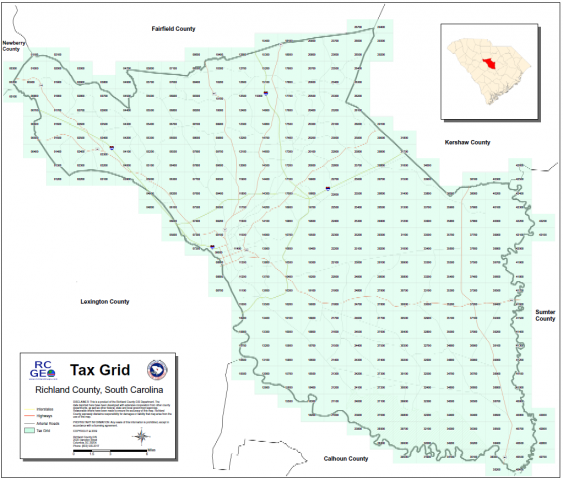

The Richland County tax map is a complex yet organized system that visually depicts each individual property within the county. It comprises various elements that work in tandem to provide a comprehensive picture of the land’s ownership, valuation, and tax obligations.

1. Parcel Identification Numbers (PINs): Each property within the county is assigned a unique PIN, which serves as its primary identifier. These numbers are typically alphanumeric and are essential for locating and referencing specific parcels on the map.

2. Geographic Coordinates: The tax map incorporates precise geographic coordinates, usually expressed in latitude and longitude, to pinpoint the exact location of each property. This ensures accurate representation and avoids ambiguity.

3. Property Boundaries: The boundaries of each parcel are clearly defined on the map, often using lines and symbols to represent fences, roads, waterways, and other physical features. This visual depiction facilitates understanding of property ownership and potential overlaps.

4. Ownership Information: The tax map displays the current owner’s name and address, providing essential information for contacting property owners and facilitating communication.

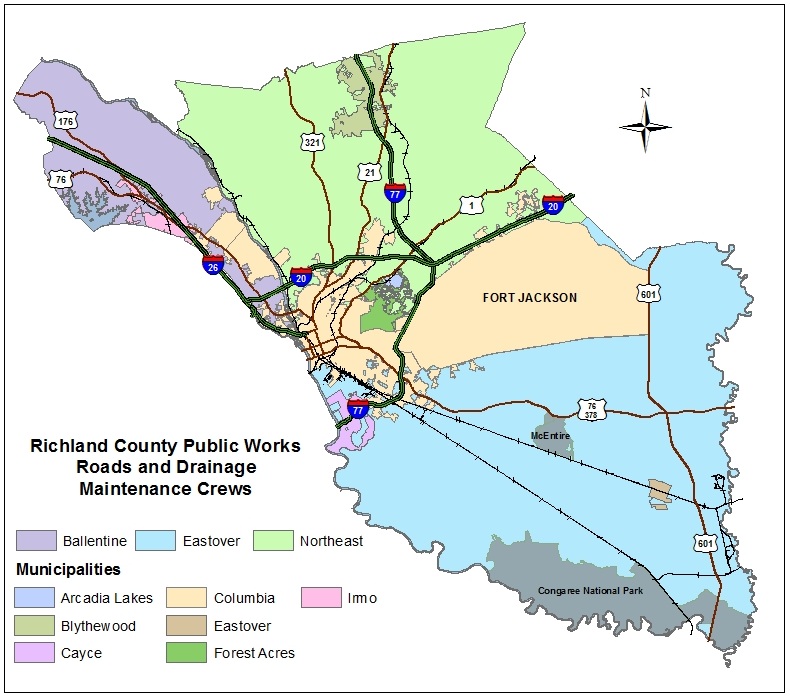

5. Zoning and Land Use: The map may also incorporate zoning information, indicating the permitted land uses for each parcel. This is vital for planning purposes and ensuring compliance with local regulations.

6. Valuation and Tax Data: While not always directly displayed on the map, the associated tax records contain crucial information about the property’s assessed value and corresponding tax liability. This data is readily accessible through the county’s assessment office.

Accessing and Utilizing the Tax Map

Richland County provides convenient access to its tax map through various channels, making it easily accessible to the public.

1. Online Platforms: Many counties, including Richland, maintain online portals where users can search for specific properties using the PIN or address. These platforms often provide interactive maps, allowing users to zoom, pan, and explore the details of each property.

2. County Assessor’s Office: The Richland County Assessor’s office serves as the central repository for all property-related information, including the tax map. Residents can visit the office in person or contact staff by phone or email to obtain specific information or request assistance with map interpretation.

3. Real Estate Professionals: Real estate agents and brokers regularly utilize tax maps as part of their due diligence process when handling property transactions. They can assist clients in understanding the map’s details and its implications for their specific needs.

Benefits and Applications of the Richland County Tax Map

The Richland County tax map serves a multitude of purposes, making it an invaluable tool for various stakeholders.

1. Property Management: For property owners, the tax map provides a clear visual representation of their property’s boundaries and ownership information. It facilitates accurate record-keeping, helps in identifying potential encroachments, and simplifies communication with local authorities.

2. Real Estate Transactions: Real estate professionals rely on the tax map to verify property boundaries, assess the feasibility of development projects, and ensure accurate property descriptions in contracts and legal documents.

3. Government Planning and Administration: The tax map is crucial for local government agencies involved in land use planning, zoning enforcement, and tax collection. It helps them accurately assess property values, allocate resources, and implement development strategies.

4. Public Access and Transparency: The availability of the tax map online and through the Assessor’s office promotes transparency and accountability within the county government. It empowers citizens to understand how their property is classified and how taxes are levied.

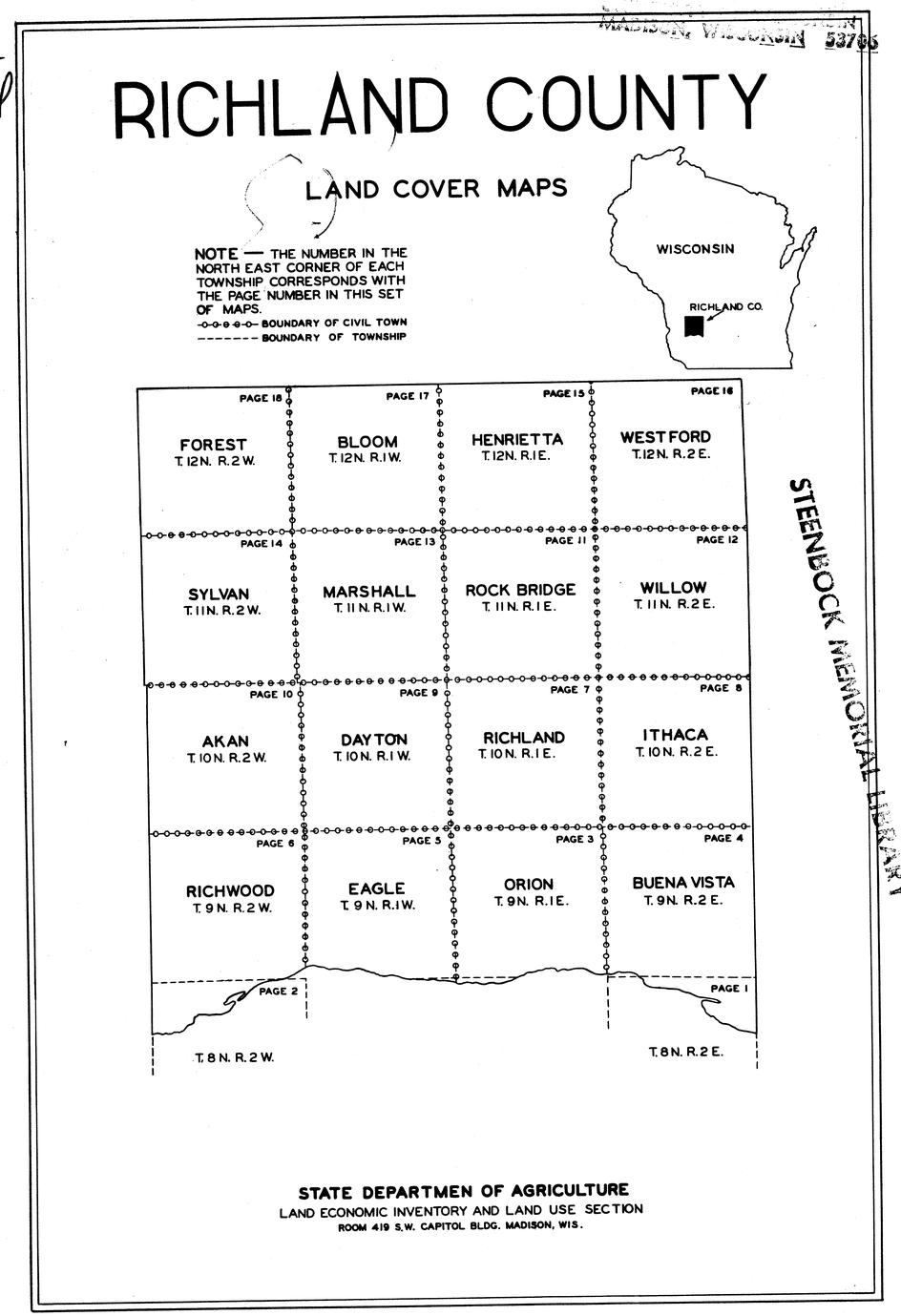

5. Historical Research and Analysis: The tax map can be a valuable resource for historical research, providing insights into land ownership patterns, property development trends, and demographic changes over time.

Frequently Asked Questions (FAQs) about the Richland County Tax Map

1. How do I find my property on the Richland County tax map?

You can access the Richland County tax map online through the county’s website. Search for your property using the PIN or address. If you need assistance, contact the Assessor’s office.

2. What information is included on the tax map?

The tax map displays the property’s PIN, geographic coordinates, boundaries, owner information, and often zoning information. It does not directly show assessed value or tax liability, but this data is accessible through the Assessor’s office.

3. Can I use the tax map to determine the value of my property?

The tax map itself does not provide property valuations. However, it can help you identify comparable properties, which can be used to estimate market value.

4. What should I do if I find an error on the tax map?

If you notice any discrepancies or errors on the tax map, contact the Richland County Assessor’s office immediately. They will investigate the issue and make necessary corrections.

5. Can I obtain a copy of the tax map for a specific area?

You can typically obtain a copy of the tax map for a specific area from the Richland County Assessor’s office. They may offer digital copies or printed versions, depending on their services.

Tips for Using the Richland County Tax Map Effectively

1. Familiarize yourself with the map’s structure and symbols: Understanding the map’s layout and the meaning of various symbols will enhance your interpretation.

2. Utilize the search functions: The online platform often offers advanced search options, allowing you to filter results based on property type, owner name, or specific geographic areas.

3. Consult with professionals: If you have complex property-related questions, seek guidance from a real estate professional or attorney to ensure accurate interpretation of the tax map.

4. Stay updated on changes: The tax map is a dynamic document that undergoes updates as property ownership, boundaries, and zoning regulations change. Check for the latest version to ensure accurate information.

Conclusion: A Vital Resource for Informed Decisions

The Richland County tax map serves as a cornerstone for property management, real estate transactions, and local government operations. Its comprehensive nature and accessibility empower stakeholders to make informed decisions regarding property ownership, development, and tax liabilities. By understanding the map’s structure, functionalities, and benefits, individuals and organizations can leverage this valuable resource to navigate the complexities of property management and contribute to the sustainable development of Richland County.

Closure

Thus, we hope this article has provided valuable insights into Navigating Property and Finances: A Comprehensive Guide to Richland County’s Tax Map. We appreciate your attention to our article. See you in our next article!